Tariff shifts reshape ocean trade heading into 2026 planning

Published: Thursday, December 11, 2025 | 09:00 AM CDT

Onthispage

Asia

Global trends

Spot rates across major export lanes are expected to remain low through December, continuing November's trend of softening prices. Carriers announced rate increases on some lanes effective 1 December 2025, but without corresponding capacity reductions, these hikes are unlikely to hold. Rate increases are only effective when capacity is constrained relative to demand; with ample availability, shippers can easily shift to lower-priced alternatives.

Capacity deployment for December appears robust, with fewer blank sailings scheduled despite the traditionally slack winter season. This continued supply abundance is keeping rates soft.

Port congestion—particularly at Rotterdam and Hamburg—continues to limit effective capacity and support healthy utilisation on Asia-Europe trades. Vessels spend longer at berth or waiting in anchorage, effectively reducing available capacity even when the ships are deployed. This “hidden” reduction helps maintain vessel utilisation rates (the percentage of container slots that are filled) amid soft overall demand.

Routeing via the Suez Canal remains limited, with CMA CGM the only carrier operating through the Red Sea. A broader resumption of Suez routes could materially affect capacity and rates by reducing transit times. Ships that currently take six weeks for a round trip via the Cape of Good Hope could complete the trip in four to five weeks via the Suez, enabling more frequent sailings with the same number of vessels.

Regional highlights

Asia to North America

Forecast: Spot rates are expected to remain under pressure through December, with both United States West Coast (USWC) and United States East Coast (USEC) lanes approaching their lowest levels of 2025.

Market dynamics: Freight rates on Trans-Pacific trade lanes remain under significant pressure as carriers maintain capacity despite weak demand. December capacity is robust, with fewer blank sailings than usual for the winter season. Historically, carriers reduce capacity 15-20% in winter to match seasonal demand, but current deployments show minimal reductions.

Carriers are expected to use selective blank sailings to manage capacity and limit rate declines. Tactical cancellations remove individual voyages when bookings are weak, preventing very low vessel utilisation. For shippers, multiple blank sailings in the same week can create short-term space constraints, leading to cargo rollovers where confirmed bookings are moved to the following week.

Asia to Europe

Forecast: Rates are expected to remain variable, with week-to-week fluctuations continuing through December. Carriers implemented a rate increase on 1 December, 2025 and space is tightening—a trend likely to persist into January as demand remains steady and capacity fills quickly.

Market dynamics: Persistent port congestion—particularly at Rotterdam and Hamburg—is reducing the amount of effective capacity available on Asia-Europe services. When vessels are delayed waiting for berth space, they are unable to complete scheduled rotations, which keeps overall utilisation higher than demand alone would support. This dynamic limits how far rates can soften, even in an otherwise softer market.

CMA CGM is preparing for a large-scale return to the Suez Canal, resuming eastbound sailings on Asia-Europe, Asia-Mediterranean and INDAMEX services from USEC to India. Starting 14 January 2026, CMA CGM plans to gradually resume westbound routeing on the INDAMEX service to the United States, targeting 10 Suez voyages by the end of the month. Other carriers remain cautious and have not yet set a date to return to the Suez Canal.

While no broader return to the Suez route is under way, such a shift remains a possibility and would materially reshape capacity and rate dynamics if adopted by multiple carriers.

If Suez routeing expands, transit times would shorten from 40-45 days (via the Cape) to 28-32 days. This would effectively increase vessel availability by 25-30% without adding ships, likely placing downward pressure on rates unless demand increases proportionally.

Key takeaways

- Monitor December rate adjustments closely, as carriers continue to push short-notice changes.

- Expect week-to-week variability on Asia-Europe lanes. Lock in favourable rates quickly, before spot market conditions shift.

- Track Suez Canal developments, as broader service resumption could reshape capacity, pricing and equipment availability.

North America

Global trends

North American export conditions continue to vary by lane, with some trades experiencing tight capacity while others still offer ample space. Global schedule reliability has risen to 65.2%, up 14.7% year over year (y/y), driven by carriers’ efforts to strengthen schedule consistency and overall operations. However, congestion across Asia, Europe, South America and the West Mediterranean continues to pressure transit times.

As a result, even with better on-schedule vessel arrivals, cargo availability can be delayed due to port backlogues, creating a disconnect between vessel arrival and final delivery.

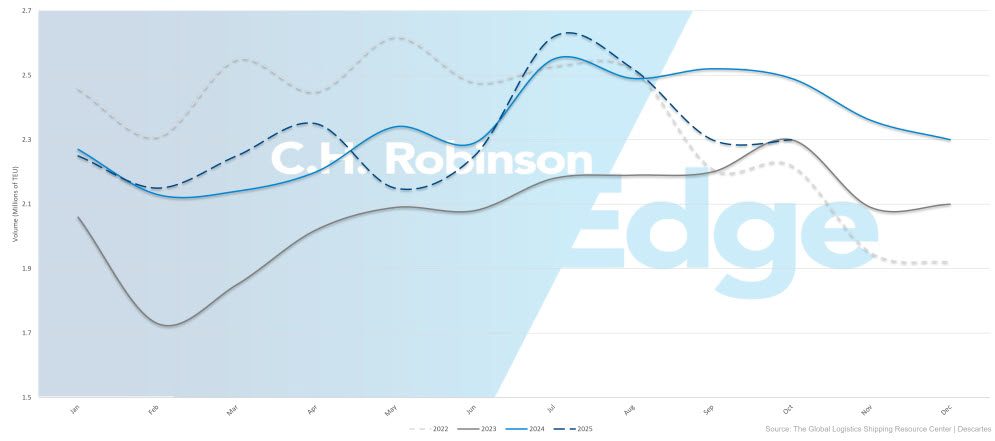

U.S. import volumes are declining as the year closes, with Global Port Tracker projecting a 19.7% drop in November and 20.1% in December. The full-year 2025 forecast now stands at 24.7 million 20-feet equivalent units (TEUs)—down 3.4% from 2024.

U.S. container import volumes

Despite softer import demand, U.S. consumers remain resilient. The National Retail Federation expects holiday spending to surpass $1 trillion for the first time during November and December, marking 3.7-4.2% growth over 2024. This divergence between consumer spending and import volumes reflects ongoing inventory rightsising, as retailers draw down existing stock rather than replenish through new imports, with gradual shifts toward domestic production and nearshoring that reduce dependence on containerised freight.

As of 10 November 2025, the United States and China have agreed to a one-year pause on vessel- and port-related taxes and a 10% reduction in International Emergency Economic Powers Act (IEEPA) tariffs, bringing the effective rate on many Chinese goods to 45%. These changes give carriers more flexibility in Trans-Pacific service deployment and offer shippers greater landed-cost predictability. It is still unclear, however, whether the tariff adjustment will materially boost U.S. import demand. Carriers continue to rely on blank sailings to balance utilisation as they watch for any demand response.

At the Port of Montreal, space constraints are tightening due to rising demand and low water levels that restrict vessel loading. Both CMA CGM and Mediterranean Delivery Company (MSC) have implemented low water surcharges to offset associated costs. Shallow water limits vessel draught, reducing how much cargo each vessel can safely load. This decreases effective export capacity even when vessel calls remain unchanged, increasing competition for space and extending booking lead times.

Regional highlights

North America to Asia

Forecast: Softening demand on the Trans-Pacific eastbound (TPEB) head-haul lane is prompting carriers to scale back services, resulting in fewer backhaul sailings from North America to Asia. Recent withdrawals include Gemini's TP9 and Premier Alliance's PS5 services. Schedule reliability is holding near 70.3%, with modest improvement expected as carriers adjust capacity and streamline remaining services for more consistent performance.

Market dynamics: Hapag-Lloyd has reinstated Ningbo on its WC5 service, restoring direct access to a key Chinese manufacturing hub. Meanwhile, congestion at major intra-Asia hubs—especially Singapore—continues to tighten space into Southeast Asia more than into North Asia. Because Singapore is a primary transshipment hub, congestion there creates longer anchorage times and missed connections, often resulting in delays of 7-14 days for cargo awaiting the next available vessel.

A 1 December 2025, general rate increase (GRI) has been filed by several carriers and is currently under negotiation.

North America to Europe

Forecast: High season conditions are expected to continue through December, with the tightest capacity originating from United States Gulf Coast (USGC) ports where export volumes remain strong and vessel options are more limited. In contrast, USEC gateways offer comparatively better space availability due to more frequent service options and larger vessel deployments.

Trans-Atlantic eastbound (TAEB) schedule reliability continues to improve and remains among the strongest globally. Blank sailings will be relatively common across all carriers in December and early January due to the holiday season, which may create temporary space constraints on specific sailing weeks.

Market dynamics: Labour disruptions and operational backlogues at key European hubs—particularly Antwerp and Rotterdam—continue to slow vessel flow and create localised congestion. As primary entry points for European markets, delays at these ports cause vessels to queue at anchorage and disrupt onward schedules, reducing effective capacity across carrier networks.

Labour actions have concluded in Antwerp and Rotterdam, though intermittent strikes across Northern Europe may continue to create schedule variability and localised congestion through December. Container and chassis shortages persist throughout the European hinterland due to congestion and ongoing driver constraints, extending inland transit times by two to four days as cargo waits for available equipment and trucking capacity. These challenges are particularly acute in Belgium, Germany and the Netherlands, where port-to-warehouse movements may face delays even when vessels arrive on schedule.

Carriers have responded by adjusting rotations, including reinstating Antwerp on USGC services to add alternative discharge options and relieve pressure on congested ports. Multiple discharge points provide operational flexibility. If one port becomes constrained, carriers can redirect cargo to another with better availability. For shippers, this may result in cargo being discharged at a different port than originally planned, potentially affecting inland transport and delivery timelines.

Low water surcharges at Montreal—implemented by MSC and CMA CGM—remain in place as draught restrictions continue to limit vessel loading. These charges compensate carriers for lost capacity and should be included in landed cost planning for cargo routed through Montreal.

North America to South Asia, Middle East, Africa (SAMA)

Forecast: Carrier options are gradually expanding beyond MSC and CMA CGM, though these two carriers still offer the most reliable coverage, with the highest sailing frequency and broadest port networks. Rates remain elevated relative to pre-disruption norms, but modest softening is possible as additional carriers enter the market and competitive pressure increases. Space to India is beginning to improve as demand cools under ongoing tariff headwinds, while Pakistan and Bangladesh remain capacity-constrained due to fewer direct service options and continued reliance on congested transshipment hubs.

Market dynamics: Transshipment hubs—including Abu Dhabi, Colombo, Jebel Ali, Mundra and key West Mediterranean ports—are expected to remain congested through the coming month, limiting routeing flexibility and contributing to 7-14-day connection delays when cargo misses intended sailings. This will continue to create uncertainty around delivery timing, particularly for shippers with just-in-time or seasonal requirements.

COSCO’s suspension of service is likely to keep regional capacity tight as the market adjusts to one fewer major carrier option. Carriers have extended existing rates through mid-December and deferred GRIs and high season surcharges (PSS) until 15 December 2025, signalling continued uncertainty about near-term demand. Over the next month, carriers may move quickly to implement rate increases if tariff relief triggers stronger booking activity. Shippers should remain prepared for short-notice rate adjustments as market conditions evolve.

North America to South America

Forecast: High season conditions are expected to continue, with schedule reliability holding at 79.6% though still below the 85%+ reliability seen on other trade lanes. Congestion at key South American transshipment hubs remains a primary source of delay, making direct services the most dependable option for maintaining schedule certainty. PSS remains in effect in several markets, particularly the Caribbean, through January 2026.

Market dynamics: Carrier performance continues to vary widely on this lane, with schedule reliability ranging from 60-90% depending on the carrier and service string. Congestion at major transshipment hubs—including Cartagena, Kingston and Panama—continues to slow indirect routings. Cargo moving through these hubs may see three to seven days of additional transit time as vessels queue for berth space and await onward connections.

Month over month schedule reliability dipped slightly while the average delay for late arrivals increased to 5.02 days. When vessels do miss schedule, delays tend to be meaningful—nearly a week late on average—though still far better than 2024 levels, when delays regularly exceeded 10 days.

Low water surcharges previously applied at Manaus have been removed by most carriers as river levels have returned to normal. This eliminates the surcharge in place earlier in 2025, offering cost relief for shippers moving cargo through Brazil’s interior.

North America to Oceania

Forecast: The market is in a soft high season. Demand is elevated compared to typical off-peak periods, but well below the holiday-driven peaks seen on other trade lanes. Space from USWC ports is slightly constrained due to a structural blank sailing that removed roughly 1,500-2,000 TEUs of weekly capacity. Even with this reduction, schedule reliability remains strong at 93%, the highest among North American export lanes. Brown Marmorated Stink Bug season, effective 1 September based on vessel on-board dates, continues to require specific treatments for at-risk cargo.

Market dynamics: Schedule reliability improved by 2.6 percentage points sequentially to 93% and is up 17.8 points y/y from 2024 levels. This reflects carriers’ increased focus on service integrity. Space remains generally available despite the structural blank sailing and rates are competitive as carriers compete for cargo in a market where capacity slightly exceeds demand.

Fumigation capacity remains limited, with no approved providers in New York. Philadelphia and Baltimore continue to offer the most reliable options for stink bug treatment. This requirement adds two to three days to cargo preparation. New Zealand-bound cargo must also be fumigated at origin to meet biosecurity standards and missing documentation can result in cargo rejection or mandatory destination fumigation—both of which add significant cost and delay.

Key takeaways

- Use USEC ports for Europe-bound cargo where space is strongest and diversify discharge ports to reduce exposure to congestion at any one gateway.

- Prioritise direct services for South America, as they help avoid three to seven day delays at congested transshipment hubs.

- Monitor tariff developments involving China and India, as policy changes can shift volumes quickly and tighten space or influence rate movements.

- Leverage East Coast Canadian ports (e.g., Halifax) for faster rail connectivity and lower dwell times, while accounting for the additional two to three days of ocean transit compared to Western Canada.

Europe

Global trends

Export markets remain favourable for shippers heading into year-end. Space is widely available and Trans-Atlantic westbound (TAWB) rates continue a gradual decline expected to extend into Q1 2026.

The Port of Rotterdam continues to see elevated dwell times—averaging roughly 14 days at RWG and about four days at ECT—while the Port of Antwerp is still facing extended vessel wait times following recent labour disruptions. In France, an early December national rail strike caused some inland connectivity delays, though maritime impacts have been minimal so far.

CMA CGM has announced the first regular eastbound Suez sailing since disruptions began—a weekly FAL1 loop departure that started 9 December from the Port of Dunkerque in northern France. This addition is expected to improve schedule reliability for cargo moving toward Asia. However, westbound INDAMEX services will begin gradually returning via the Suez Canal starting 14 January 2026. Maersk recently met with the Suez Canal Authority but confirmed it will not resume Suez transits until security conditions materially improve.

Regional highlights

Europe to Asia

Forecast: A December GRI is expected to achieve modest rate increases. CMA CGM's Suez eastbound service launch on 9 December, 2025, represents a significant development, though full industry resumption awaits broader carrier participation.

Market dynamics: CMA CGM’s decision to route eastbound sailings through the Suez Canal will cut transit times from the current 40-45 days (via the Cape of Good Hope) to approximately 28-32 days. Shorter voyages would mean ships can complete more round trips in the same timeframe, effectively boosting capacity by an estimated 25-30% on the eastbound leg.

Meanwhile, westbound INDAMEX services will continue via the Cape for now, reflecting a cautious risk management approach as security concerns and insurance exposure remain elevated in the Red Sea region. This asymmetric routeing (Suez eastbound/Cape westbound) aims to capture transit time improvements where operationally feasible while minimising exposure on the return leg. CMA CGM plans to gradually resume westbound Suez sailings starting 14 January 2026.

Europe to North America

Forecast: Rates will continue their slow downward trend through December into Q1 2026. Space remains readily available across all carriers, with favourable conditions expected through the first half of 2026.

Market dynamics: Adequate vessel capacity and stable demand are sustaining downward pressure on rates. Carriers are offering competitive pricing on longer-term contracts—especially for higher-volume commitments—as they look to secure stronger forward volume visibility. At the same time, operational delays at key northern European ports, particularly Rotterdam and Antwerp, are driving longer container dwell times, which heightens detention and demurrage exposure for shippers.

Europe to South America

Forecast: Rates to South America are expected to remain stable through year-end, with space generally available.

Market dynamics: A balanced supply-demand environment is keeping rate levels relatively steady and capacity widely available. With carriers able to accommodate current volumes without major constraints, shippers are benefiting from greater flexibility in booking windows, service selection and routeing options.

Europe to Oceania

Forecast: Rates are expected to remain stable, with open capacity supporting relatively short booking lead times—often less than three weeks.

Market dynamics: Capacity continues to outpace current demand, which is helping maintain steady pricing and reasonable scheduling flexibility. Most shippers can secure space without premium solutions unless they have highly time-sensitive or specialised cargo.

Key takeaways

- Account for Rotterdam dwell times and potential Antwerp delays when calculating transit times.

South Asia, Middle East, Africa (SAMA)

Global trends

CMA CGM has tested multiple voyages through the Suez Canal in recent weeks, though most major carriers continue to avoid the route due to ongoing security concerns in the Red Sea and Gulf of Aden. Carriers are monitoring the situation closely and may gradually resume canal transits as conditions improve, but a broad, industry-wide return remains unlikely in the near term. Full resumption depends not only on regional stability but also on insurers reinstating coverage for Red Sea passages—a process that could extend several months. For now, the Cape of Good Hope remains the primary routeing option.

With global networks still dependant on Cape of Good Hope transits, effective industry capacity is reduced by an estimated 10%. Longer voyage times (40-45 days vs. 28-32 days via Suez) limit the number of annual round trips per vessel, while the additional 3,500 nautical miles adds increased fuel and operating costs per round trip, supporting higher rate levels and continued PSS.

High U.S. tariffs of up to 50% continue to suppress Indian export demand, with October deliveries down 8.6% y/y. The rate of decline is slowing, however and a pending U.S.-India trade deal could reduce tariffs to 15-16%. Such a shift would significantly improve price competitiveness and likely trigger a demand rebound.

Carriers have extended current rates through 14 December 2025 and deferred GRIs and PSS to 15 December 2025. With multiple void sailings scheduled in December, the market could tighten quickly if tariff reductions spur a volume surge. Reduced capacity combined with a sudden increase in demand would likely create immediate space constraints and upward pressure on rates.

Regional highlights

SAMA to North America

Forecast: Space remains open across all major lanes, with equipment—both containers and chassis—readily available at primary ports and inland container depots. This marks a notable improvement from early 2025, when India lanes faced frequent shortages. However, multiple void sailings scheduled through December could tighten space quickly if volumes rebound following potential tariff relief. Carriers have already pulled 15-20% of deployed capacity due to soft demand, leaving the market exposed to sudden shifts in volume.

Market dynamics: The current 50% tariff structure has sharply reduced trade flows, pushing vessel utilisation on India-U.S. lanes down to 60-70% from typical levels of 85-90%. This surplus capacity gives shippers strong leverage on rates and space commitments. Export demand from India is expected to stay soft in the near term due to U.S. tariffs of up to 50%, following an 8.6% y/y decline in October. Although exports from India to the United States remain down y/y, the pace of decline is stabilising as buyers adjust sourcing strategies and Indian exporters recalibrate pricing.

Tariff reductions could unlock pent-up demand. Many U.S. importers have delayed orders or shifted sourcing while awaiting tariff clarity; if implemented, these deferred orders could convert quickly into new bookings. Carriers have extended existing rates through mid-December and deferred GRIs and PSS until 15 December.

Planned void sailings continue to remove weekly capacity from schedules. If demand returns faster than expected, these cancelled sailings could create instant space constraints, as carriers typically need four to six weeks to restore capacity—repositioning vessels, assigning crews and securing terminal windows. This could temporarily tighten the market and push spot rates higher until capacity is reinstated.

SAMA to Europe

Forecast: Demand from the Indian Subcontinent (ISC) to northern Europe and the Mediterranean is expected to remain steady through December, keeping volume levels stable. Space should stay accessible across most services, with carriers not signalling any near-term schedule disruptions or capacity cuts.

Market dynamics: Rate levels remain subdued across India-Europe trade lanes, reflecting steady but restrained demand and ample vessel space. Spot rates are currently 30-40% below peak 2024 levels, creating favourable conditions for shippers. To maintain network efficiency in this softer market, carriers are making targeted, sailing-specific adjustments—deploying smaller vessels or consolidating loads across services—rather than turning to broad blank sailing programmes.

As the industry enters the typical contracting window for 2026, carriers are prioritising forward volume visibility through annual contract negotiations. Securing committed volumes provides them with revenue stability and supports more accurate capacity planning. For shippers, this environment presents an advantageous moment to secure favourable long-term agreements. With rates stable and capacity open, early 2026 is shaping up to be relatively predictable, with limited risk of sudden rate spikes or space constraints.

Key takeaways

- Monitor Suez Canal routeing updates, as a broad return to Suez could cut transit times by 10-14 days.

- Track India-U.S. tariff negotiations closely; be ready to shift booking strategies within two to three weeks if tariff relief is announced.

- Prepare for potential mid-December rate increases on SAMA-North America lanes.

South America

Global trends

The fruit export season from Chile and Peru is tightening vessel space on South America West Coast (SAWC) lanes, with harvest volumes peaking December-January. Holiday-driven demand for avocados, cherries and grapes is pushing booking windows from the usual one to two weeks to three to four weeks. Because fresh produce is time-sensitive, exporters compete simultaneously for limited refrigerated capacity, creating concentrated demand spikes during harvest windows.

On the East Coast, U.S. tariffs on select Brazilian products have reshaped trade flows. Brazilian coffee exports to the United States were down approximately 52% through September and sugar down more than 80%. These declines reflect U.S. buyers switching to alternative origins to avoid tariff costs—not any reduction in Brazilian supply—representing a major change in long-established trade patterns.

Regional transshipment hubs in Cartagena, Panama and other ports have improved berth productivity and processing times, boosting reliability on indirect routings. These gains have narrowed the transit penalty of transshipment services from roughly 10-14 days to about 5-7 days, making indirect options more competitive for cargo that can tolerate a slightly longer transit time in exchange for better pricing.

Regional highlights

South America to Asia

Forecast: Carriers are actively seeking cargo across all commodity types to fill vessels on this traditionally low-density trade lane, prioritising 40-feet units to maximise vessel utilisation. Grain volumes continue to rise as Chinese buyers diversify away from U.S. suppliers. This diversion is creating new South America-Asia trade flows that may become long-term patterns, even if geopolitical conditions later stabilise.

Market dynamics: Paper, wood and cotton deliveries remain subdued, reflecting weaker demand from key Asian import markets. Slower construction and manufacturing have dampened paper and wood volumes, while Chinese cotton mills are drawing down existing inventories rather than purchasing new supplies, creating a temporary ceiling on cotton exports.

In contrast, grain exports—particularly soybeans and sesame—are rising sharply as Chinese buyers seek alternatives to U.S. suppliers due to tariff measures. Soybeans remain a structural requirement for China’s pork industry, generating consistent demand that Brazil and Argentina are now supplying. South American grain exports to China have increased 35-40% y/y, representing roughly 15-20 million tons of cargo and creating sustained demand for vessel capacity.

To manage utilisation, carriers are actively promoting available space with competitive rates. Forty-feet containers are in highest demand, as grains and other voluminous agricultural products reach cubic capacity before weight limits, optimising vessel slot usage and reducing per-unit handling costs. Shippers should account for the longer transit time of 35-40 days to Asia versus 18-25 days to Europe or North America while taking advantage of favourable rates and capacity availability.

South America to North America

Forecast: The 50% U.S. tariff on select Brazilian products has changed trade flows, with some shippers delaying movements. As a result, Brazilian coffee and sugar exports to the United States have dropped sharply, prompting exporters to redirect volumes toward Asia, Europe and the Middle East—markets not affected by the tariff and currently offering more stable demand conditions.

Market dynamics: Brazilian coffee deliveries to the United States have dropped sharply enough to push the United States from its long-standing role as Brazil’s top buyer to third place, behind Germany and Italy. Sugar exports to the United States have seen a similarly steep decline, with most of that volume now flowing to Asian markets where demand remains strong. These changes have required Brazilian exporters to establish new buyer relationships, adjust logistics networks and in some cases modify product specifications to meet different market requirements. While this causes short-term disruption, it also broadens Brazil’s long-term market diversification.

Colombia and Mexico are becoming increasingly important destinations for Brazilian coffee thanks to their geographic proximity and established trade channels. At the same time, U.S. importers are backfilling reduced Brazilian supply by shifting to tariff-free origins in these same markets. Carriers—including MSC, CMA CGM and One Network Express (ONE)—are adjusting by sourcing cargo through Colombia, Mexico, Peru and Canada to maintain vessel utilisation, though these alternative routings typically add three to seven days compared to direct Brazil-U.S. services.

Operational improvements at major transshipment hubs have shortened delays from five to seven days earlier in 2025 to two to three days, making indirect routings more viable for cost-sensitive cargo as the transit penalty narrows.

South America to Europe

Forecast: Space availability now requires four weeks of advance booking, with vessels running at 95-100% utilisation, a sharp shift from the typical 70-80% during non-peak periods. Demand for special cargo, including oversized, project and high-value deliveries, is expected to rise through the end of the year as infrastructure projects accelerate spending before year-end and manufacturers move high-value inventory ahead of holiday closures. Coffee volumes are also increasing, as U.S. tariffs on Brazilian coffee continue to push more deliveries toward Europe, with Germany now absorbing much of the volume previously destined for the United States.

Market dynamics: Carriers including MSC, CMA CGM and ONE are shifting calls away from London gateway due to ongoing congestion and extended dwell times of 7-10 days. Southampton and Felixstowe, with average dwell times of three to five days, have become preferred alternatives. Although rerouting adds 12-24 hours of sailing time, faster inland operations result in quicker overall delivery for time-sensitive cargo.

Coffee exports from Brazil continue to flow heavily toward Europe, with Germany now the primary destination. European roasters and distributors are increasing long-term commitments with Brazilian suppliers, supporting strong and steady demand on Brazil-Europe lanes through 2026 independent of U.S. tariff changes.

During the sugar season (April-November, with export peaks from August-December), carriers are prioritising 40-feet dry containers for light, high-volume cargo like coffee and sugar to maintain vessel balance. This makes advance planning essential. Shippers of light commodities and special cargo should secure equipment four to six weeks ahead, as specialised equipment and optimal container types tighten quickly during peak periods.

Key takeaways

- Book early for Chile and Peru fruit exports, reserving refrigerated container capacity and vessel space at least three to four weeks in advance during peak harvest periods.

- Plan Europe-bound deliveries carefully, booking at least four weeks in advance.

- Monitor U.S.-Brazil tariff developments.

- Leverage South America-Asia lane opportunities, taking advantage of rates 20-30% below peak 2024 levels. Carriers are actively seeking cargo to maintain vessel utilisation, but longer 35-40-day transit times should be factored into inventory planning.

Oceania

Global trends

Export capacity from Australia and New Zealand remains tight, with most services requiring three- to four-week advance bookings to secure confirmed space. Limited carrier options and vessel availability on Oceania lanes contribute to this extended booking window. Demand on USEC lanes remains strong, driven by consumer goods imports and agricultural exports, keeping space constrained and rates elevated. Flows into Southeast Asia have eased as regional economic growth moderates, creating ample space and competitive rates.

Equipment availability is improving as carriers reposition containers to meet export demand, though transshipment delays at Singapore persist. Congestion at this key hub can add two to three weeks to transit times if cargo misses connecting vessels.

Schedule reliability is stabilising as carriers recover from earlier port omissions and mechanical disruptions, while reduced congestion at European ports lowers delay risks for Oceania-Europe services. Overall, rates are broadly steady as the quarter ends, finding equilibrium after volatility earlier in 2025.

Key takeaways

- Plan export deliveries three to four weeks in advance to secure space on preferred sailing dates and vessel services, especially for USEC-bound cargo, to avoid rollovers that can add 7-10 days to delivery timelines.

- Expect continued pressure on USEC lanes due to sustained demand.

- Monitor potential port schedule changes and rotations, as carriers may skip ports with low cargo volumes, which could require last-minute adjustments to inland transportation plans.

Download slides

Download slides